Japan’s largest automaker is struggling as low-priced Chinese language EV makers, like BYD, proceed gaining an edge. Toyota’s world output fell for the primary time in 4 years within the first half of 2024. Is the corporate’s sluggish shift to EVs accountable?

Toyota’s world output drops amid sluggish EV shift

It’s no secret by now that Toyota is without doubt one of the greatest laggards within the business’s transition to all-electric autos.

The corporate constructed 4.71 million autos within the first half of fiscal 2024, down 7% from the report 5.06 million constructed final yr. That is additionally the primary time in 4 years that Toyota’s world manufacturing has slipped.

After halting manufacturing of the favored Yariss Cross and Corolla Fielder because of improper car certifications in Japan, Toyota’s home output slipped 9.4% within the first half of the yr.

Toyota stated a recall on the Prius hybrid additionally led to decrease manufacturing. Abroad, Toyota’s manufacturing slipped almost 6% to three.17 million items. In North America, quantity was down by 1.7%, whereas in Europe, quantity was up by 3.2%.

Toyota was hit particularly arduous in China, with output crashing 17%. Like many legacy automakers, Toyota is struggling to maintain tempo with Chinese language EV leaders like BYD with extraordinarily low-priced fashions.

BYD’s least expensive EV, the Seagull, begins at underneath $10,000 (69,800 yuan) and continues to sit down atop the gross sales charts.

Between April and September 2024, Toyota’s world gross sales fell 2.8% to five million items. This was the primary decline in two years, with home (-9.3%) and abroad (-1.6%) falling.

Though EV gross sales rose 32.5% to 78,178 items, Toyota lower manufacturing plans for all-electric autos by 30% by 2026.

Toyota now expects to construct round 1 million EVs by 2026, down from its earlier 1.5 million goal.

Electrek’s Take

As one of many slowest automakers to transition to all-electric autos, Toyota is feeling the stress. And it’s not solely in China.

Chinese language EV makers, like BYD, are rapidly increasing abroad because the home market is turning into saturated with low-priced opponents.

BYD launched its third EV in Japan this summer season, the Seal, which is usually in comparison with Tesla’s Mannequin 3. The Seal joins the Dolphin and Atto 3, two of BYD’s top-selling EVs. Beginning at round $24,500 (¥3.63 million), the Dolphin EV is a direct menace to the Toyota Prius and Nissan LEAF.

Earlier this month, The Central Japan Financial and Commerce Bureau held a seminar (through Nikkei) to discover traits within the EV business.

The occasion showcased round 90,000 components from 16 overseas automakers, and round 70 auto components corporations had been in attendance.

BYD’s Atto 3 electrical SUV, which begins at underneath $20,000 (140,000 yuan) in China, stole the present. One visitor requested, “How can it’s produced at such a low value?”

On Wednesday, BYD reported report Q3 income and earnings as car gross sales continued surging to new ranges.

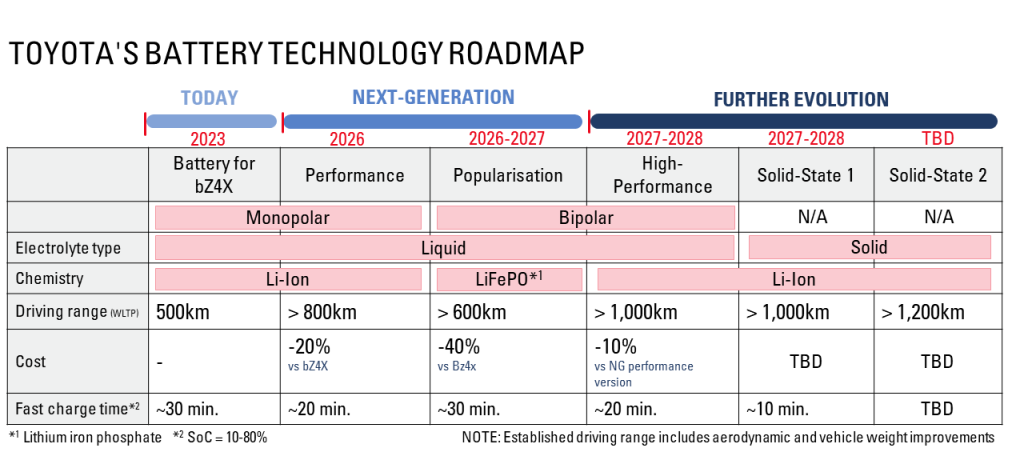

With Toyota promising its next-gen batteries will allow extra environment friendly, lower-priced EVs, will it’s too little too late? The corporate says its “Popularisation” LFP batteries, due out by 2027, will present over 373 miles (600 km) WLTP driving vary.

In keeping with information from CnEVPost, BYD accounted for almost a 3rd of the LFP batteries put in in China in September. In China, LFP batteries account for nearly 75% of the market.

Supply: Toyota, Kyodo Information

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.