Tesla CEO Elon Musk, in Thursday’s annual shareholder assembly, referred to as himself “a useful accelerant” to the corporate’s future, as shareholders accepted a pay bundle for Musk valued at $46 billion based mostly on present inventory costs.

In the meantime, one side that was as a result of change the corporate’s trajectory, reduce prices, and allow the whole lot from a $25,000 Tesla EV in 2023 to mass-production of the Semi in 2021 hasn’t but arrived in 2024: the dramatic value reductions of Tesla’s 4680 cells.

“With respect to our personal cell manufacturing, we do see a path to value parity by the tip of this yr—a really tough path to value parity,” Musk summed.

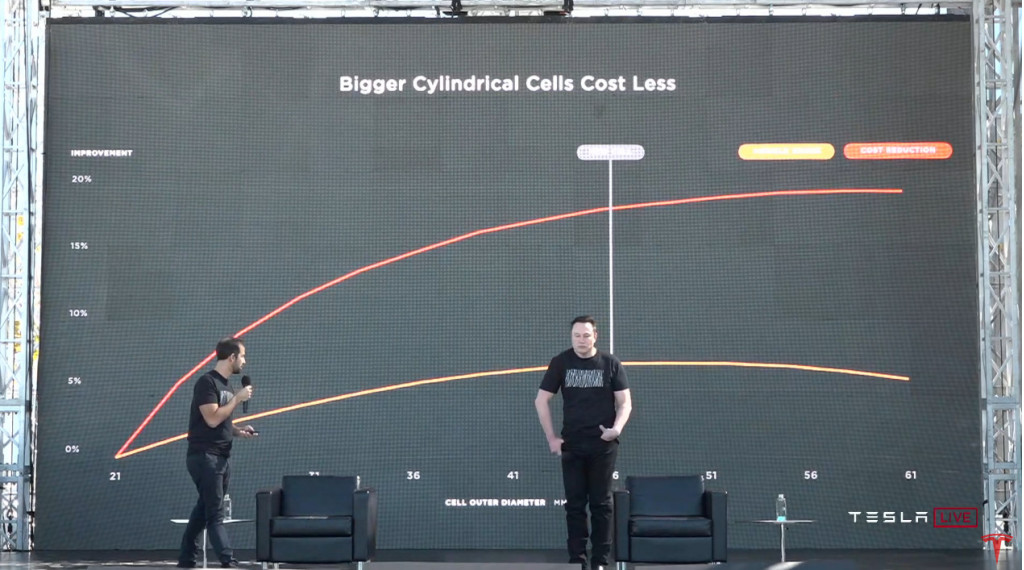

Battery Day and 4680 aimed to halve the associated fee

Whereas Musk is now speaking about value parity, it’s a really completely different actuality for Tesla’s signature battery transfer, practically 4 years after its September 2020 Battery Day. Tesla made the 4680 cells and its personal future manufacturing of them the centerpoint of that occasion and claimed it might make the breakthrough cell at half the associated fee, on an power foundation, versus suppliers—and boasted that it might even provide it to different automakers.

Evaluating 4680 vs. 2170 – Panasonic

“At the moment our 4680s value greater than our suppliers’,” Musk revealed on Thursday, as he famous the volatility of EV battery costs. “They value greater than the suppliers’ in the present day however they value lower than the suppliers’ a yr in the past.”

“There’s a little bit of a feast-famine factor with battery cell suppliers, sort of for VRAM chips,” he added. “However we count on to realize value parity, even be a lot decrease than the provider cell worth in the present day, by the tip of the yr.”

Tesla’s massive battery guess hasn’t paid off—but

The price of EV battery cells has certainly been a rollercoaster journey. After Battery Day, EV battery value soared to new heights in 2022, hampering EV affordability. Lithium-ion battery costs dropped by 2023 and into this yr, however they’re not displaying indicators of stopping. Goldman Sachs analysts now anticipate an almost 40% decline in EV battery costs between 2023 and 2025, which in flip will enhance gross sales.

Tesla Battery Day – Greater prices much less

In so many respects, the economics of EV battery provide are trying very completely different than how they offered round Battery Day. There’s now such a worldwide glut in battery manufacturing, should you contemplate China, that China itself now makes sufficient batteries to cowl all international EV manufacturing, in accordance with an evaluation earlier this spring by Bloomberg New Vitality Finance. And in format, no different main automaker has but dedicated to the 4680 cylindrical format (46 mm diameter, 80 mm top). BMW has, for example, as an alternative dedicated to 4695 (identical 46 mm diameter, higher 95 mm top).

Musk had mentioned in 2021 that with out Tesla’s personal manufacturing of the 4680 cells, it wouldn’t have sufficient for mass-production of the Semi—a stage of Semi ramp that Musk solely confirmed on this week’s occasion.

In 2021, Panasonic’s high battery government mentioned that mass-producing the 4680 cell format would “require new strategies.” However that didn’t cease different high battery suppliers from vying to make the brand new format.

2025 Tesla Cybertruck – Courtesy of Tesla, Inc.

Tesla’s VP of engineering Lars Moravy did give an replace on 4680 manufacturing throughout the firm’s Q1 monetary name in April, suggesting it’s at a charge resulting in about 7 gigawatt-hours per yr, with sufficient to remain forward of the manufacturing ramp of the Cybertruck, which is in any other case the one mannequin to make use of them.

As Musk talked about, Tesla could quickly have the ability to match different batteries and battery makers, however half the associated fee nonetheless appears as distant now because it did in 2020.