In case you ask Lucid (Lucid) CEO Peter Rawlinson, the corporate is the “most immune” EV maker if President-elect Donald Trump cuts the federal tax credit score for electrical vehicles. Regardless of the declare, Lucid’s inventory is hitting a brand new all-time low at below $2 a share.

Is Lucid proof against dropping the EV tax credit score?

Lucid is coming off its third straight report quarter of deliveries. With one other 2,781 automobiles offered in Q3, Lucid’s supply whole reached 7,142 via the primary 9 months of 2024, already topping the 6,001 deliveries in 2023.

Nonetheless, share costs are sinking following a Reuters report on Thursday that Trump’s transition staff is “planning to kill” the federal EV tax credit score, which gives as much as $7,500 for clear automobile consumers.

The report additionally cited two sources claiming that representatives from Tesla (TSLA) advised Trump’s staff that they supported the plans to finish the subsidy.

CEO Elon Musk, who absolutely endorsed Trump, stated dropping the credit score may barely affect Tesla’s gross sales however could be “devastating” to others within the US.

Though its luxurious Air sedan, beginning at $69,900, doesn’t qualify for the $7,500 credit score, Lucid is passing it on to some via leasing. Nonetheless, Rawlinson stated lots of its purchasers make greater than the $150,000 for single filers and $300,000 threshold for {couples} submitting collectively.

Due to that, even when Trump cuts the EV tax credit score, Lucid’s CEO believes it’s in a stronger place than a lot of the competitors.

When requested about Trump’s plans, Rawlinson stated on Bloomberg Tv on Friday that “Lucid, amongst all of the EV makers, is de facto essentially the most immune from that.”

Lucid’s CEO additionally stated he isn’t frightened about Musk getting favorable remedy when Trump takes workplace. Rawlinson defined:

We’ve actually taken the mantle of expertise management from Tesla proper now, and this isn’t actually sufficiently acknowledged. So, I believe we’re in a really robust place to climate any such storm.

Lucid opened orders for its first electrical SUV earlier this month. Beginning at $79,800, the Lucid Gravity is predicted to get a powerful vary of 440 miles per cost.

Rawlinson calls the Gravity a “landmark product” with its most superior expertise but, which he claims is “years forward of the competitors.” Final month, we received our first look at its lower-priced midsize electrical SUV. Costs for the brand new mannequin will begin at below $50,000.

It will likely be the primary of at the very least three midsize Lucid EVs, with manufacturing anticipated to start in late 2026. Rawlinson stated the midsize fashions are aimed “proper within the coronary heart of Tesla Mannequin 3, Mannequin Y territory.”

Regardless of the boldness, Lucid’s inventory hit its lowest value on Friday since going public in July 2021. Lucid shares are down practically 17% this week, sitting at below $2 per share.

Electrek’s Take

Ending the federal tax credit score will put your complete US auto business behind. China continues to achieve extra international market share as leaders like BYD increase into key abroad markets like Europe, Southeast Asia, and Central and South America.

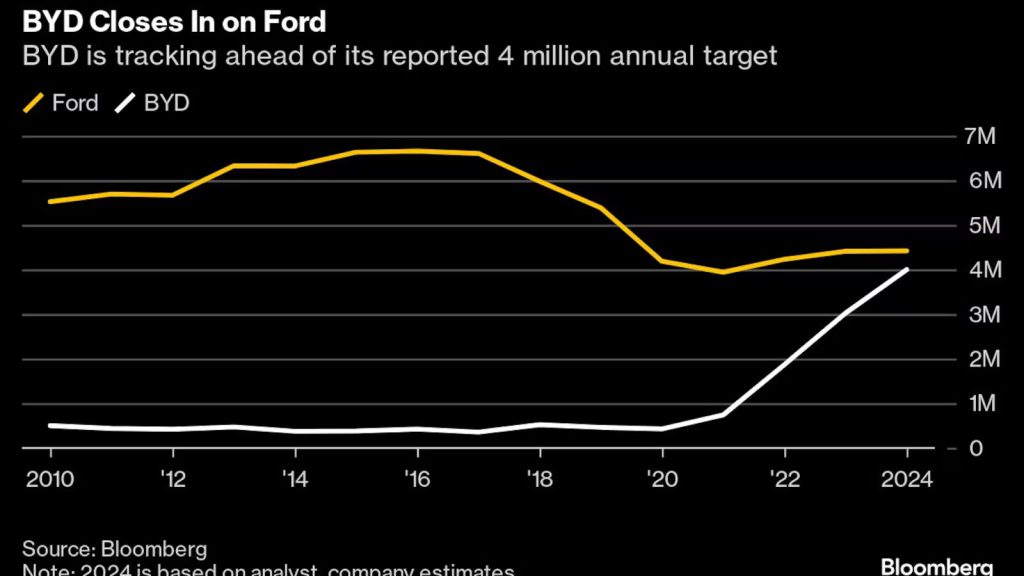

The truth is, in line with Bloomberg, BYD is rapidly closing in on Ford in international deliveries and will even prime the American automaker by the top of 2024.

BYD’s surging international presence is primarily attributable to its early beginnings as a battery maker. Nonetheless, China’s authorities can also be fueling EV gross sales development with subsidies for people who commerce in gas-powered automobiles.

In keeping with Rho Movement, China continues dominating the worldwide market with a report 1.2 million EVs offered in October alone. China has now offered 8.4 million EVs in 2024, up 38% year-over-year (YOY), in comparison with 1.4 million within the US (+9% YOY).

Rawlinson could also be proper. Lucid might be some of the immune if the tax credit had been minimize. Nonetheless, different US automakers, like Ford, GM, and Jeep-maker Stellantis, is probably not as fortunate.

So, what occurs if the subsidies are killed off? American automakers will doubtless delay or cancel extra EV initiatives (new fashions, battery vegetation, manufacturing amenities), which is able to ship them additional behind within the international market.

Ford’s CEO Jim Farley warned rivals earlier this 12 months, saying if they can not sustain with the Chinese language, “then 20% to 30% of your income is in danger.” He added, “Because the CEO of an organization that had bother competing with the Japanese and the South Koreans, we’ve got to repair this drawback.” Ending subsidies would solely put them additional behind.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.